If you’re looking for a practical and adaptable framework for managing your finances, the 50/30/20 budgeting method may be the right solution for you. Dividing your after-tax income into basic categories including essential needs, personal wants, and financial goals, this approach not only helps you to effectively track and control your expenses, but also ensures that your long-term financial well-being …

Financial Fitness: How to Save $1,000 Quickly

We all know that it’s important to have money set aside for the future—whether it’s long-term goals or a rainy-day fund for unexpected expenses. Unfortunately, saving money isn’t always easy. Whether you’re living paycheck to paycheck, are struggling with debt, or simply never developed the habit, like many others, you may find it difficult to prioritize saving money. In fact, …

Master Your Money: A Quiz to Test Your Financial Literacy

Citizens State Bank is proud to celebrate Financial Literacy Awareness Month this April by inviting you to participate in our Financial Literacy Quiz! We believe in empowering our community with the knowledge and tools necessary for financial wellness. Our quiz is designed to test your understanding of basic financial concepts, including saving, investing, budgeting, and credit management. Whether you’re a …

Revamping Your Colorado Home: Top Renovation Ideas

Colorado’s growing economy, natural beauty, and lifestyle appeal have contributed to a steady increase in home values. This can create conditions ripe for home renovations for two important reasons. Firstly, current homeowners may find it makes more sense to renovate their existing homes, rather than face a tight real estate market. Additionally, that increased equity in homes can be converted …

From Ground Up: A Step-By-Step Home Construction Financing Guide

Building a home is a complex process. From finding the right location to creating the plans, it’s not an undertaking to go into lightly. To add to the intricacy of the process, financing for building a home—versus buying an existing home—is also more complicated. Many individuals building their homes will go through three separate lending products (or more!) in order …

New Year, No Debt: Your Guide to Recovering from Christmas Spending

Every year, you work hard to give your loved ones a wonderful holiday experience. Whether it’s giving them their dream presents, throwing festive gatherings, or traveling long distances to be together, the costs associated with the holidays can quickly add up, often landing in your lap in the form of bloated credit card bills and depleted savings come January. Starting …

Together We Thrive: Citizens State Bank’s Dedication to Local Causes

Nestled in the heart of our beloved hometowns—Naturita, Ouray, Ridgway, Silverton, and Telluride—Citizens State Bank (CSB) has remained a steadfast community pillar since 1913, 100% locally owned. It’s in these towns, where small-town pride thrives, and everyone knows their neighbors, that CSB shines as a remarkable example of community support. With an unyielding commitment to our local community, CSB has …

The Importance of Banking Local with Citizens State Bank

For over 110 years, Citizens State Bank has been part of the communities of Naturita, Ouray, Ridgway, Silverton and Telluride. We’re not just your local bank; we’re your neighbors, your friends, and your biggest cheerleaders. Banking with us goes beyond transactions and balances. It’s about sharing stories, building trust, and growing together. Banking local keeps the dream alive for small …

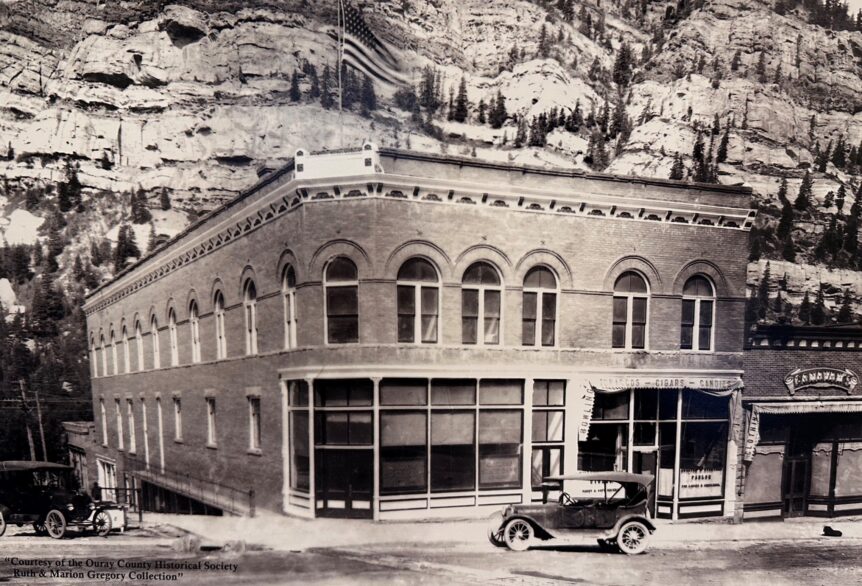

Celebrating Our 110th Anniversary

When we opened our doors on August 29, 1913, in the picturesque town of Ouray, we had one primary mission: to serve our community. Now, as we stand tall, celebrating our 110th anniversary, we’re filled with gratitude, pride, and a deeper understanding of the commitment we made over a century ago. The word ‘community’ resonates deeply with us. Back in …