If you’re looking for a practical and adaptable framework for managing your finances, the 50/30/20 budgeting method may be the right solution for you. Dividing your after-tax income into basic categories including essential needs, personal wants, and financial goals, this approach not only helps you to effectively track and control your expenses, but also ensures that your long-term financial well-being is always prioritized.

Curious about this popular budgeting system? In this post, we’ll explore the basics of the 50/30/20 system, how to use it to analyze your spending and build your financial plans, as well as ways you can customize the spending categories to meet your unique needs and goals.

Why is budgeting so important?

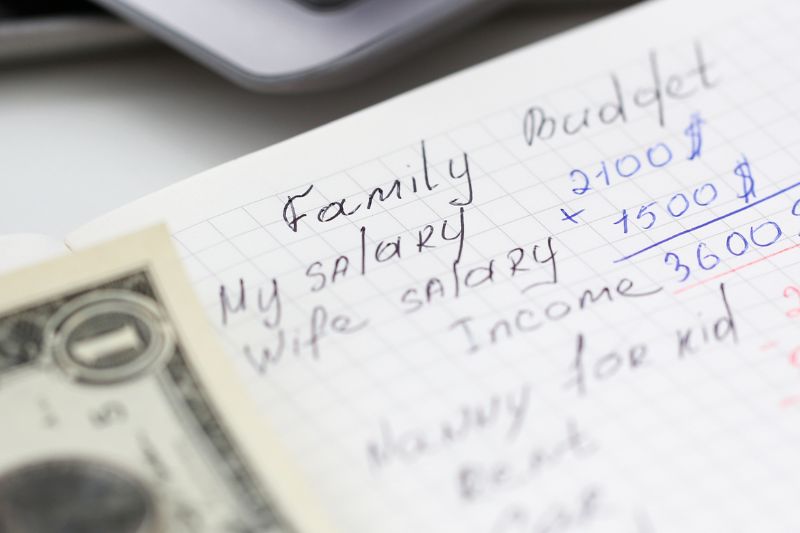

When you live paycheck-to-paycheck, knowing how much money you can expect to get and where every dollar is going is crucial for making sure that your bills are paid and your needs are met. Budgets are crucial for averting financial catastrophe, by helping to prevent ballooning debt or credit issues.

However, even if you manage to easily balance your income and expenses without budgeting, creating and following a budget can have many additional benefits:

- Increased Financial Awareness: Budgeting helps you gain a clear understanding of where your money goes, essential for making informed financial decisions.

- More Control Over Finances: Take control of your financial situation, rather than let your finances control you. Budgeting helps you prioritize spending and avoid unnecessary debt.

- Achieve Financial Goals More Easily: When you create a budget, you create an active plan for achieving specific financial goals, whether it’s saving for a house, retirement, or emergency funds.

- Reduced Stress: A well-planned budget can reduce financial stress by removing the uncertainty around bills and expenses. With 74% of working Americans reporting to be stressed about their personal finances, budgeting can provide relief for nearly everyone.

- More Marital Harmony: One in five divorces stem from money issues. When you work with your spouse to create a budget and set agreed-upon spending limits, you can reduce friction about money matters.

- Better Prepared for Emergencies: Budgeting can help you set aside funds to create a safety net for unexpected expenses, boosting financial stability.

What is the 50/30/20 Budgeting Method?

The 50/30/20 budgeting method was designed to simplify budgeting, making sure that you keep your different kinds of spending in proportion. With this method, you allot:

- 50% of your income for needs

- 30% of your income for wants

- 20% of your income for financial goals, including savings and debt repayment

Popularized by Elizabeth Warren in her 2006 book, All Your Worth, the simplicity of this budgeting strategy has made it a popular choice for individuals for nearly two decades.

The beauty of the 50/30/20 method is that it doesn’t emphasize austerity—the reason why many strict budgeting plans fail over time. Instead, nearly a third of your take-home pay is allocated to wants, giving you greater freedom over lifestyle choices.

Additionally, the 50/30/20 method offers flexibility. Adjust a category’s percentage up or down based on your current financial situation or objectives. Just keep the spirit of the system in mind—especially the emphasis on financial goals.

How to Implement the 50/30/20 Budget

While the general idea of this budgeting method is straightforward, implementing it as a spending and savings strategy can still require a bit of legwork as you wade through all your expenses.

Let’s take a look at each category to get a better understanding of how to classify each expenditure and determine how well your current spending patterns align with the 50/30/20 breakdown.

Needs: 50%

The “needs” category includes all necessary expenses—shelter, food, healthcare, and transportation. These are expenses that you must pay in order to maintain your basic lifestyle, job, and ongoing wellbeing.

“Needs” expenses include:

- Housing: Rent or mortgage payments, property taxes, homeowners’ association fees, homeowners’ or renters insurance.

- Utilities: Electricity, gas, water, sewage, trash removal, cell phone, internet.

- Groceries: Food and supplies essential for cooking, as well as household items like cleaning products.

- Healthcare: Health insurance premiums, co-pays, HSA or FSA contributions, necessary medical expenses, prescriptions.

- Transportation: Car payments, car repairs, auto insurance, fuel, public transportation costs.

- Basic Personal Care: Necessary hygiene products.

- Childcare and Education: Daycare, babysitting, child support, educational costs for children.

- Additional Insurance Policies: Necessary insurance policies like property and life insurance.

- Minimum Loan Payments: Minimum payments on debts such as student loans, credit cards, or personal loans.

Within this category, some individuals may spend more than others or certain items. For instance, someone may get by with a low-cost, used vehicle, while someone else may choose a nice, new leased vehicle. The differences between how you choose to spend each dollar of your “needs” is less important than ensuring that no more than 50% of your budget is spent on them.

Wants: 30%

This category covers all the non-essential expenses that provide enjoyment or improve the quality of your life. Permitting yourself some wants is perfectly fine, and can be an important part of a fulfilling lifestyle. But each individual want is not essential for basic living—and keeping them to 30% or less is crucial to a balanced budget.

“Wants” expenses include:

- Dining Out: Restaurant meals, takeout, coffee shops, treats.

- Entertainment: Movies, concerts, sporting events, hobbies, streaming services, books.

- Travel: Vacations, weekend getaways, day trips, hotel stays.

- Shopping: Non-essential clothing, electronics, home decor.

- Gym Memberships and Fitness Classes: Unless they are essential for health as prescribed by a doctor.

- Subscriptions and Memberships: Magazines, online subscriptions not essential for work or education.

- Personal Care: Salon visits, spa treatments, cosmetic products beyond basic needs.

- Gifts and Donations: Charitable donations, gifts for friends, family, teachers, and coworkers.

- Upgraded Phone or Internet Plans: Higher-cost plans with extra features.

- Hobbies and Leisure Activities: Art supplies, sports equipment, club memberships.

Sometimes differentiating between a “need” and a “want” can be difficult. And some categories—like clothing—can really blur the lines. Ultimately, as long as your wants generally stay below 30% and your needs generally stay below 50%, the exact breakdown isn’t as important as the fact that you aren’t spending beyond your means, and you’re always reserving 20% of your income for the final category.

Financial Goals: 20%

The final portion of your budget may be the smallest percentage-wise, but it is the most important when you think of your long-term financial health. The purpose of this category is to build financial security and independence. While everyone’s financial goals will look a little different, savings—retirement and rainy day—are key to any good financial plan.

Let’s take a look at what your financial goals may entail:

- Emergency Fund: Savings for unexpected expenses, including uncovered medical emergencies, home and car repairs, and lost income due to unemployment. Aim to build a 3-6 month emergency fund or rainy day fund over time.

- Retirement Savings: Contributions to retirement accounts like 401(k)s, IRAs, or other pension plans. Aim to save 10% to 15% of your income for retirement each year.

- Debt Repayment: Payments above the minimum on credit cards, student loans, personal loans, auto loans, and other loans with higher interest. This does not include standard monthly payments like your monthly mortgage payment.

- Investments: Stocks, bonds, mutual funds, and real estate investments—in addition to your retirement savings.

- Savings for Goals: Saving for a down payment on a house, a new car, education, or other significant expenses.

You may find that it’s hard to fit all your goals into that 20% figure—especially if you have a lot of debt, have a big savings goal, or need to catch up on retirement savings. In some cases, you may need to adjust your percentages to better meet your goals.

When It’s Okay to Adjust the Ratio

The 50/30/20 rule’s simplicity is its biggest merit. But there are some cases when those exact percentages just won’t work with a specific financial situation or objective. Let’s explore a few scenarios when you may need to adjust the proportions.

Lots of Debt

If you have a significant amount of debt—especially high interest credit card debt—you may want to consider adjusting to allocate more towards debt repayment. For example, you might go for a 50/20/30 rule, where 30% is dedicated to financial goals (including debt repayment) and only 20% to wants, until your debt (and spending) is better under control.

Within this 30% for financial goals—it’s important to still set aside money for savings, including an emergency fund and retirement. For instance, you may choose 20% for debt repayment, 5% for emergency savings, and 5% for retirement, doubling your savings once your debts have been paid down.

Aggressive Saving Goals

If you’re aiming to save for a big goal, like buying a house or early retirement, you might also choose to adjust the financial goals category. One possible ratio would be a 50/25/25 plan, boosting your savings by 5% to help you reach your goals faster.

Lower Income

Unfortunately, during times of high inflation and housing costs, your “needs” allotment won’t go as far. If you are in a lower income bracket, necessary spending may consume a larger portion of your budget, as much as 60% or even 70%. Do your best to reduce spending where you can, but know that some things are out of your control.

In these cases, simply reduce the other categories to accommodate increased spending on needs. Just be sure that some portion of your income (aim for at least 10%) is devoted to financial goals. For example, a workable budget breakdown may be 65/25/10.

Higher Income

If your income is higher, you’ll be privileged with greater flexibility. You might choose to increase savings and investments significantly, especially if your essential needs consume far less than 50% of your income (40/20/30). You may also increase spending on wants to accommodate additional charitable giving (40/40/20).

Stable Financial Situation with No Debt

Perhaps you’ve paid off your mortgage, your income is stable, or you’re already retired. If you’re debt-free and have stable finances, you might opt for a more balanced approach. Options include a 40/30/30 budget, where you give your savings a little bit of a boost, or a 40/35/25 budget, where you grant yourself more leisure time or increase your charitable giving.

Other Tips for Customization

If you plan to adjust the ratios, keep in mind these best practices:

- Prioritize Needs: Always ensure your essential needs are covered first. This might mean sacrificing some wants or financial goals in the short term.

- Stay Flexible: Regularly review and adjust your budget as your financial situation and goals change.

- Consider Future Goals: Even if you can afford more wants now, consider the impact of saving more on your future financial stability.

- Balance is Key: Avoid allocating too much to any one category at the expense of others. A balanced approach is typically more sustainable and satisfying.

- Seek Professional Advice: If you’re unsure about how to allocate your budget, consider consulting with a financial advisor for personalized advice.

Staying Disciplined and Motivated

Adjusting your spending habits—and its effect on your lifestyle—can be daunting at first. Maintaining a strict budget, with little room for error or enjoyment, can also prove unsustainable in the long run. So how do you ensure that your budget has sticking power?

- Set Clear Financial Goals: Having specific, achievable goals gives purpose to your budgeting efforts.

- Visualize Your Progress: Use charts or graphs to visualize how close you are to achieving your goals, like paying down debt or saving for a down payment.

- Regular Reviews: Regularly review and adjust your budget allocations. This can help catch issues early, keep you focused, and ensure that your budget accurately reflects your current situation.

- Involve Family or Partners: Shared goals and teamwork can increase motivation and accountability and reduce conflict.

- Educate Yourself: Understanding the impact of good financial habits can be a huge motivator. Read books, follow finance blogs, or attend workshops in person or online to learn more about financial wellness.

Taking Control of Your Finances

At Citizens State Bank, we work hard to help our customers achieve their financial goals. From checking accounts with online banking features that can help you stay on top of your spending to savings accounts to grow your rainy day fund or nest egg, our products and services are designed to make managing your money and reaching your financial goals simple and accessible.

Reach out to us or visit your local branch location in Mountain Village, Montrose, Naturita, Ouray, Ridgway, Silverton, or Telluride today to learn more about how we can help you take control of your finances.